unemployment tax refund calculator

The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support. Well calculate the difference on what you owe and what youve paid.

Average Tax Refund Up 11 In 2021

For questions call the EDD Taxpayer Assistance Center.

. Each state also decides on an annual SUTA limit so that an employees earnings. If you paid less you may owe a balance. Calculate what your weekly benefits would be if you have another job.

Even if you do not use TurboTax to file your tax return you can still use the tax calculator for free. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. Work out your base period for calculating unemployment.

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. The other sections will calculate your taxable income and find credits and deductions you can claim on your return. Simple tax calculator to determine if you owe or will receive a refund 1040EZ Tax Calculator The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form.

The IRS will automatically recalculate the tax you owe and issue a refund if you overpaid your unemployment income tax. The best part is that while the calculator. Taking advantage of deductions.

Ad Prevent Tax Liens From Being Imposed On You. The ranges are wide. Kentuckys range for example is 03 to 9.

It might take several months to get it. Before we jump to your questions you may want to see how your unemployment income will affect your taxes. This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form.

For more information refer to How Unemployment Insurance Benefits Are. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Calculate the highest quarter earnings with a calculator.

The American Rescue Plan also adjusted the eligibility requirements for the Earned Income Tax Credit which means that more taxpayers may qualify. Line 7 is clearly labeled Unemployment compensation 4 The total amount from the Additional. Toll-free from the US or Canada.

However there are a few cases where filing an amended return may make sense. Maximize Your Tax Refund. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income that must be included on your 2020 tax return.

However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Simply select your tax filing status and enter a few other details to estimate your total taxes. The difference between the tax you owe and the tax you owed when originally filing should be your refund line 24 on you 1040.

Brush up on the basics. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. Outside the US or Canada.

Is my income taxable. January 3 2022 Tax Calculators Tax Refunds. By filling in the relevant information you can estimate how large a refund you have coming.

You can include your unemployment income in our tax calculator to get an estimate of your tax liability or potential refund. If your mailing address is 1234 Main Street the numbers are 1234. If all three of those conditions are true The IRS will recalculate your tax return and send you the additional refund.

Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. So our calculation looks something like this. See your tax refund estimate.

However not everyone will receive a refund. If they reported the maximum exclusion amount of 10200 their overpayment could have been as much as 264 or 528 on a joint return many would want to claim those amounts. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week.

A written request for extension must be received within 60 days from the original delinquent date of the payment or return. Take a look at the base period where you received the highest pay. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Most types of income are taxable. 10200 x 2 x 012 2448 When do we receive this unemployment tax break refund. This can change if you qualify for earned income tax credit.

So far the refunds have averaged more than 1600. This is only applicable only if the two of you made at least 10200 off of unemployment checks. The refunds totaled more than 510 million.

Up to 10 cash back Our tax refund calculator will do the work for you. 10200 x 2 x 012 2448 When do we receive this unemployment tax break refund. Calculate your unemployment benefits for every week if the partial gross income is different.

If you recieved 10200 or more in unemployed subtract 10200 from your taxable income line 15. Already filed a tax year 2020 tax return. It is not your tax refund.

If youve already paid more than what you will owe in taxes youll likely receive a refund. Answering your unemployment income questions To help you make sense of it all well answer 3 important questions. Most Arizonans who received unemployment were probably in the 259 tax bracket said Bob Kamman a Phoenix tax-return preparer.

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Tax Return Calculator Your Details Done Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount.

Youll fill out basic personal and family information to determine your filing status and claim any dependents. This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits. Employee 3 has 37100 in eligible FUTA wages but FUTA applies.

Your household income location filing status and number of personal exemptions. CPA Professional Review. Once you submit your application we will verify your eligibility and wage information to determine your weekly benefit amount.

Look at a federal tax table to see your amount of tax owed. TurboTax has created a handy tax refund calculator that will allow you to know how much you can expect to receive back before you file your tax return. Each state decides on its SUTA tax rate range.

It might take several months to get it. How Income Taxes Are Calculated. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

Your Adjusted Gross Income AGI not including unemployment is less than 150000. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

Millions Of Americans Won T See Their Tax Refunds For Months Time

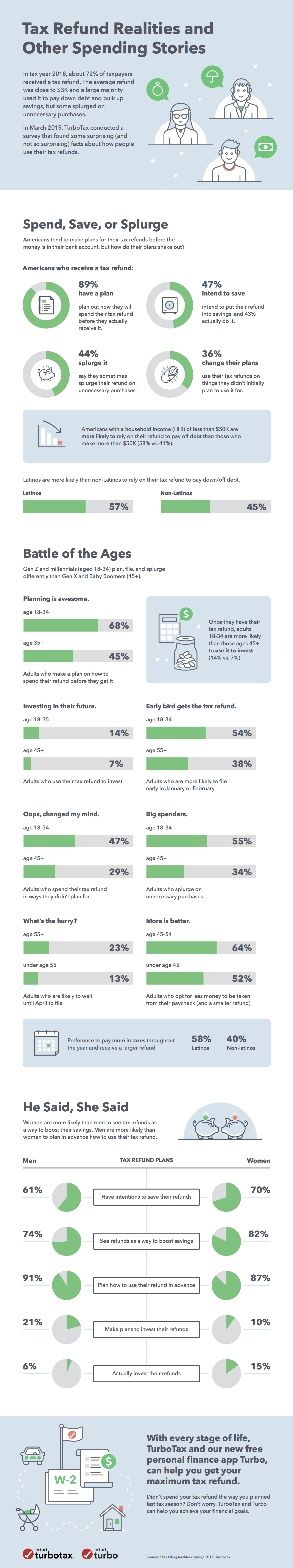

Tax Refund Realities And How Americans Spend And Save Their Tax Refunds Infographic The Turbotax Blog

Don T Make These Tax Return Errors This Year

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Why Tax Refunds Are Taking Longer Than Usual

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

Here S How To Get A Bigger Or Smaller Tax Refund Next Year

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Calculate Your Tax Refund 2022 Turbotax Canada Tips

Jitendra Tax Consultants Is A Registered Tax Agent With Fta And Provide Tax Related Services Our Expert Team Gives Vat Registrat Tax Consulting Accounting Tax

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

Pin By Law Offices Of Kenneth P Carp On St Louis St Charles Bankruptcy Unemployment Estate Planning Attorney Filing Taxes Income Tax Return Tax Return

How To Get The Largest Tax Refund Possible Pcmag

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Will I Get A Tax Refund This Year What To Expect For Tax Refunds In 2022 2022 Turbotax Canada Tips